Fee Charts

The fees for XtraCash vary by state depending on local regulations. There are also different rate options available depending on the level of participation of the Credit Union and the source of the payment.

State Fee Charts

Kansas Fee Schedule

| Advance Amount (amount financed) | Fee Amount (finance charge) | Annual Percentage Rate APR* (assumes 14-day term) | Total Amount (total of payment) |

|---|---|---|---|

| Rate 1 | |||

| $100.00 | $10.00 | 260.71% | $110.00 |

| $200.00 | $20.00 | 260.71% | $220.00 |

| $300.00 | $30.00 | 260.71% | $330.00 |

| $400.00 | $40.00 | 260.71% | $440.00 |

| $500.00 | $50.00 | 260.71% | $550.00 |

| Rate 2 — Repayment from CU checking or savings account | |||

| $100.00 | $13.00 | 338.93% | $113.00 |

| $200.00 | $26.00 | 338.93% | $226.00 |

| $300.00 | $39.00 | 338.93% | $339.00 |

| $400.00 | $52.00 | 338.93% | $452.00 |

| $500.00 | $65.00 | 338.93% | $565.00 |

*APR will increase for a term of less than 14 days and will decrease for a term of greater than 14 days. See your agreement for disclosure of APR.

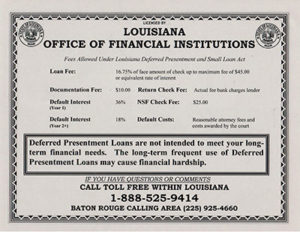

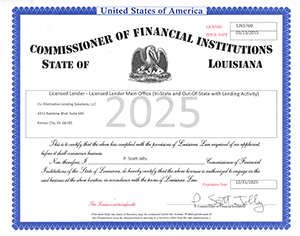

Louisiana Fee Schedule

| Advance Amount (amount financed) | Fee Amount (finance charge) | Annual Percentage Rate APR (assumes 14-day term) | Total Amount (total of payment) |

|---|---|---|---|

| $100.00 | $12.00 | 312.86% | $112.00 |

| $125.00 | $15.00 | 312.86% | $140.00 |

| $150.00 | $18.00 | 312.86% | $168.00 |

| $175.00 | $21.00 | 312.86% | $196.00 |

| $200.00 | $24.00 | 312.86% | $224.00 |

| $225.00 | $27.00 | 312.86% | $252.00 |

| $250.00 | $30.00 | 312.86% | $280.00 |

| $275.00 | $33.00 | 312.86% | $308.00 |

| $300.00 | $36.00 | 312.86% | $336.00 |

| $325.00 | $39.00 | 312.86% | $364.00 |

| $350.00 | $42.00 | 312.86% | $392.00 |

Loan amounts available in $25 increments.

*APR will increase for a term of less than 14 days and will decrease for a term of greater than 14 days. See your agreement for disclosure of APR.

Missouri Fee Schedule

| Advance Amount (amount financed) | Fee Amount (finance charge) | Annual Percentage Rate APR (assumes 14-day term) | Total Amount (total of payment) |

|---|---|---|---|

| Rate 1 — Repayment from CU checking or savings account AND financial education participation | |||

| $100.00 | $10.00 | 260.71% | $110.00 |

| $200.00 | $20.00 | 260.71% | $220.00 |

| $300.00 | $30.00 | 260.71% | $330.00 |

| $400.00 | $40.00 | 260.71% | $440.00 |

| $500.00 | $50.00 | 260.71% | $550.00 |

| Rate 2 — Repayment from CU checking or savings account | |||

| $100.00 | $13.00 | 338.93% | $113.00 |

| $200.00 | $26.00 | 338.93% | $226.00 |

| $300.00 | $39.00 | 338.93% | $339.00 |

| $400.00 | $52.00 | 338.93% | $452.00 |

| $500.00 | $65.00 | 338.93% | $565.00 |

Loan amounts available in $25 increments.

CUSTOMER NOTICE: There are a wide variety of loan products available in the marketplace, so your choice of lending products should match your financial needs. Small-dollar loans used over a long period of time can be expensive.